Contents

In this article, we will discuss the Income Tax Act 2025: What You Must Know Before It’s Too Late!.

The focus area will be to understand the newly introduced approaches, updates Income Tax slabs, NFTs, Crypto currencies, Pension schemes and ITR filing process etc.

“It was only for the good of his subjects that he collected taxes from them, just as the Sun draws moisture from the Earth to give it back a thousand-fold”

– Kalidas

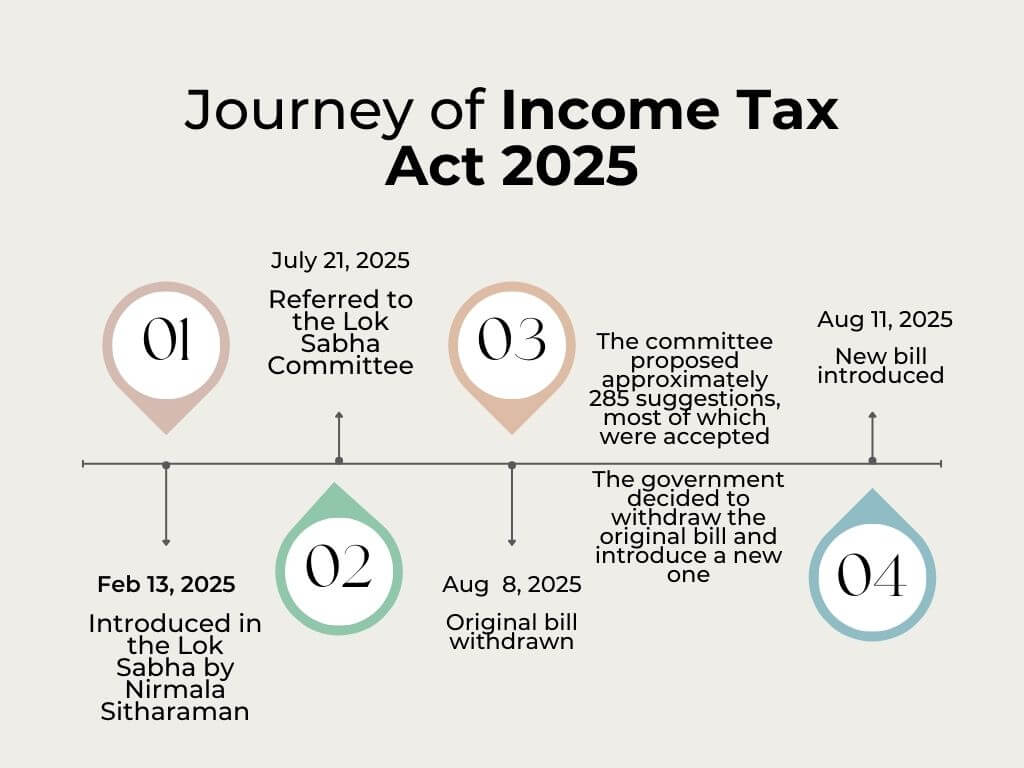

The New Income Tax Bill 2025 is is in the news. It aims to replace six-decade-old Income Tax Act of 1961, promising a simpler, more efficient, and less litigious tax system.

This iterative process highlights the government’s commitment to refining the tax system based on expert feedback.

Major Changes in Income Tax Act 2025: A Simpler and More Digital Approach

The New Income Tax Bill 2025 brings several significant changes:

1. Simple Structure and Language

- The bill aims for simpler drafting and reduced overlapping provisions.

- The number of sections has been reduced from approximately 800 to 536.

- The language is designed to be easily understandable by the average person.

2. Terminology Updates

- The bill proposes using the term “Tax Year” instead of “Previous Year” and “Assessment Year” to reduce confusion.

3. Tax Rebates Remain Unchanged

- The tax rebate remains unchanged for income up to ₹12 lakh, providing continuity for taxpayers.

4. Digital-First and Faceless Approach

- The bill emphasizes a digital-first approach to facilitate hassle-free filing for honest taxpayers.

- The faceless assessment system will be further strengthened to reduce direct interaction and potential harassment.

Key Changes for NGOs and Trusts

The bill also introduces significant changes for Non-Governmental Organizations (NGOs) and Trusts:

- Anonymous Donations: Donations exceeding ₹1 lakh or 5% of total anonymous donations (whichever is higher) will be taxed.

- Religious Trusts: Only purely religious trusts will be exempt from tax.

- Expenditure Requirement: Trusts must spend 85% of their income annually on approved purposes to avoid taxation.

- Limited Income Passing Options: The options for passing on income are now limited.

- Business Income Limit: NGO’s business income cannot exceed 20% of total receipts to maintain tax benefits.

- Mandatory Compliance: Proper books of accounts, audits, and tax returns are mandatory.

- Wrong Investments: Incorrect investments will be subject to immediate taxation.

Clarity on Crypto currencies and NFTs

- Clearly defined as virtual digital assets.

- These will be taxed like stocks or property at flat rate.

- Taxation on these assets remain unchanged i.e. 30% on gains + 1% TDS and no offsets.

ITR(Income Tax Return) Filing Guidelines

- Now, refund of ITR will be allowed even if ITR filed after the due date.

- This will benefit the tax payers as they will have the opportunity to reclaim the overpaid tax.

Guidelines on UPS(Unified Pension Scheme)

- Up to 60% of corpus will be tax free.

- Uniform treatment across the pension schemes is adopted. The benefits of NPS schemes will be applicable for UPS as well.

Concerns Raised

The below are some areas of concerns raised by experts-

- The scope of investigator access now included online space like email, cloud storages and digital wallets. This is seen as the privacy breach for the tax payers.

- During investigation, authorities can override passwords to access the required data.

- Encrypted or hidden digital data is also under the radar of the authorities.

- Scope of assets now includes tangible assets, digital assets, demat holdings and virtual assets.

- The limit for holding the attached assets by government officials is now increased to indefinite period or until the proceeding concludes.

Conclusion

Overall, government has taken a positive step towards making the Income Tax Act more friendly for the tax payers. It has cleared the confusion around many vague areas which were usually the point of discussion. Having said that, there are concerns for tax payers privacy and possibility of misuse of power given to the authorities with this act which needs a strict monitoring for a better implementation.

Read more about the act here.

Visit our Home Page to read more such articles.